Includes information on average tariff rates and types that US. Last published date.

Sst Tariff Code Estream Software

The HS code is a worldwide terminology for the classification of items.

. 2022 updates to the HS codes. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. AHTN is used for trade transaction between Malaysia and.

This code is globally unified and can be acquired online. An HS Code is a code that represents a geographical location. In January 2022 the WCO published the 7th edition of the HS with slight amendments to the HS code rules.

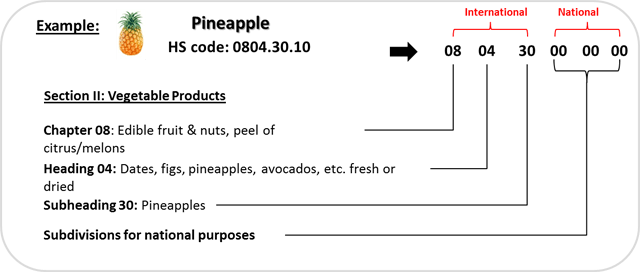

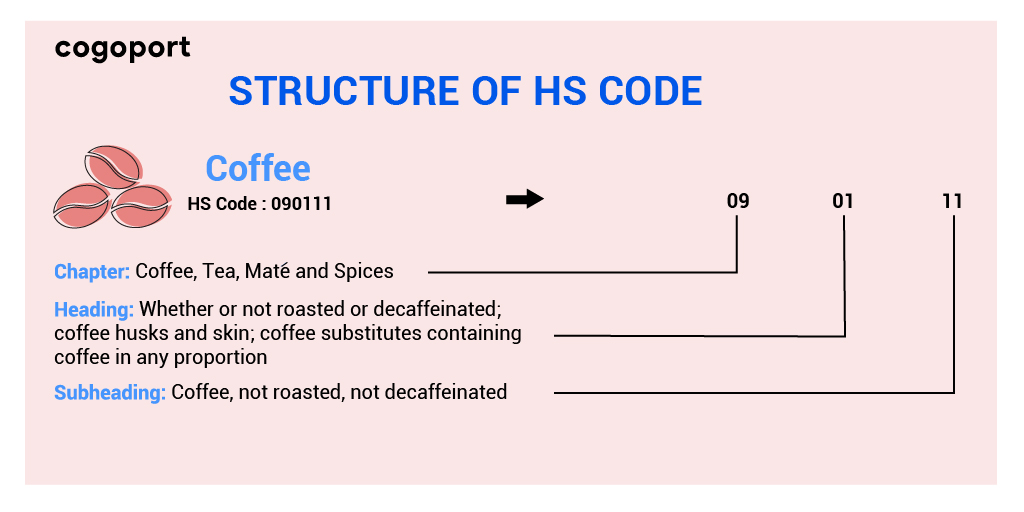

Every commodity is tagged to an HS code and the code assigned to it is internationally recognized in almost every country and is commonly used in customs to clear shipments. Harmonized System HS Codes. HS commodity code is categorized into 2-digit 4-digit 6-digit 8-digit level.

It is maintained by World Customs Organization WCO. HS Code of Malaysia is commonly 9 or 10 digits. According to the Harmonised System HS maintained by the World Customs Organization WCO tariff codes are product-specific codes.

Materials certified to the Commissioner of. 731816 8701 0501 84714900 etc. More than 98 of world trade uses it so its really important.

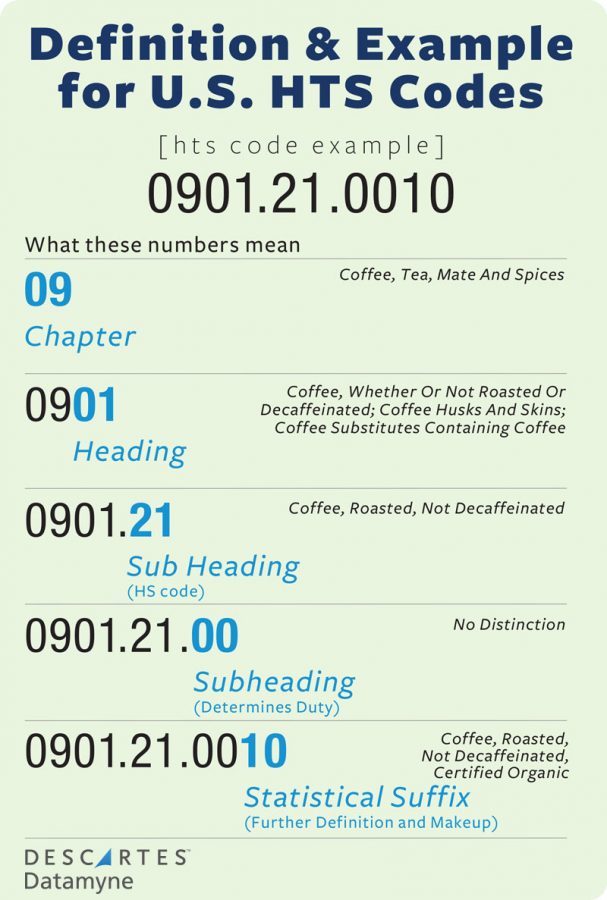

97 rows What Are Harmonized System HS Shipping Codes. In order to ship internationally goods must carry the HS Harmonized Commodity Description and Coding System Code a 6- to 10-digit. The first six digits of each HTS code identify products traded internationally.

Worldwide it is a six-digit code framework for grouping and. The first 4 digits commodity code is Header representing the categories of commodities. 010512000 - - Turkeys.

HS code is the global standard for classifying trading products. A tariff code is a product-specific code as documented in the Harmonised System HS maintained by the World Customs Organisation WCO. Tariff codes exist for almost every product involved in global commerce.

3 HS codes that you must know on importing precious metals into Malaysia HS Code 1. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. The WCO updates its HS code system every five years.

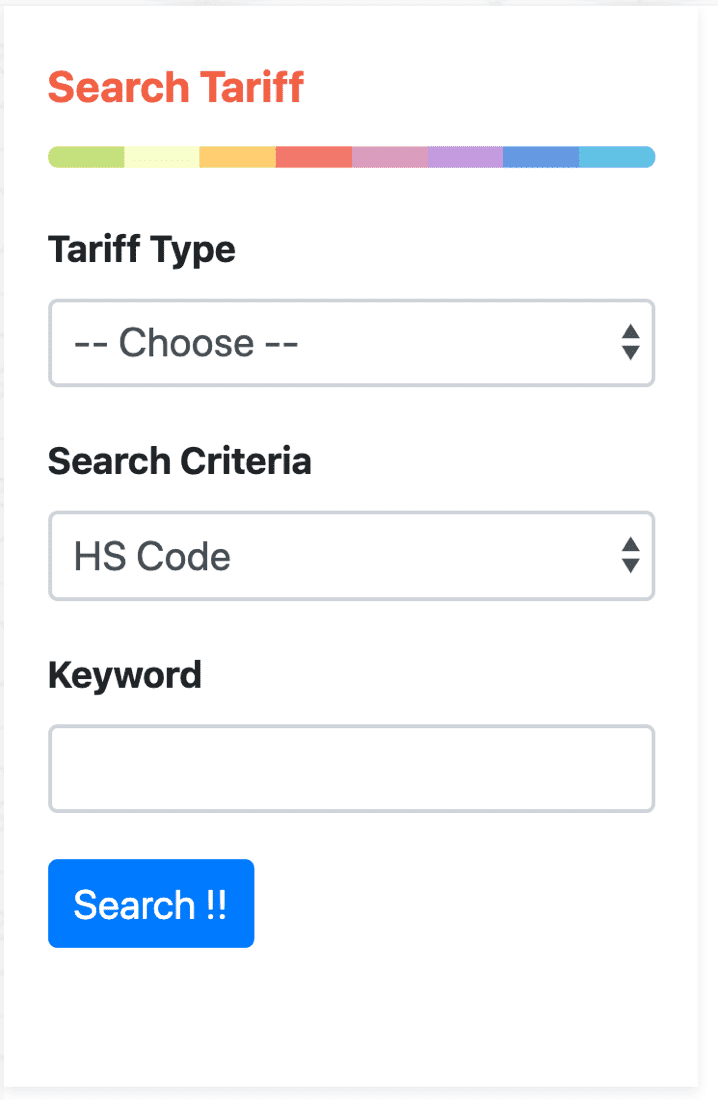

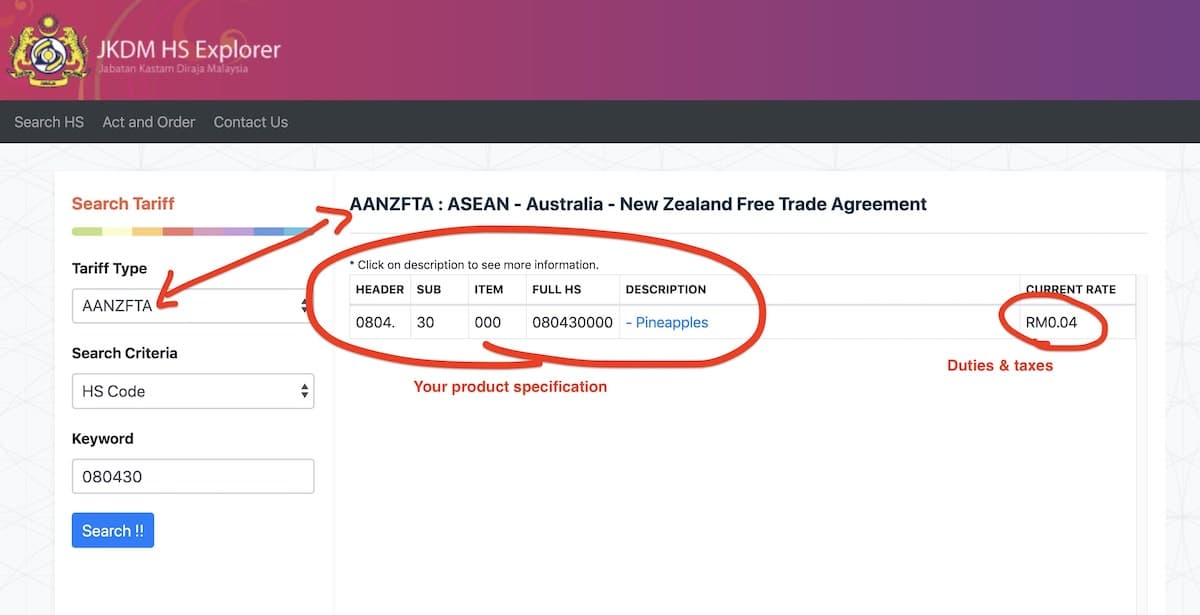

Simply input a valid HS Code like. It helps customs in various countries to make sure that they are talking about the same product and the HS code of a product also determines the import duties. Malaysia custom hs code.

There should not be fewer than. For certain goods such as alcohol wine poultry and. It is a product-specific code as stated in the Harmonised SystemHS maintained by the World Customs OrganisationWCO.

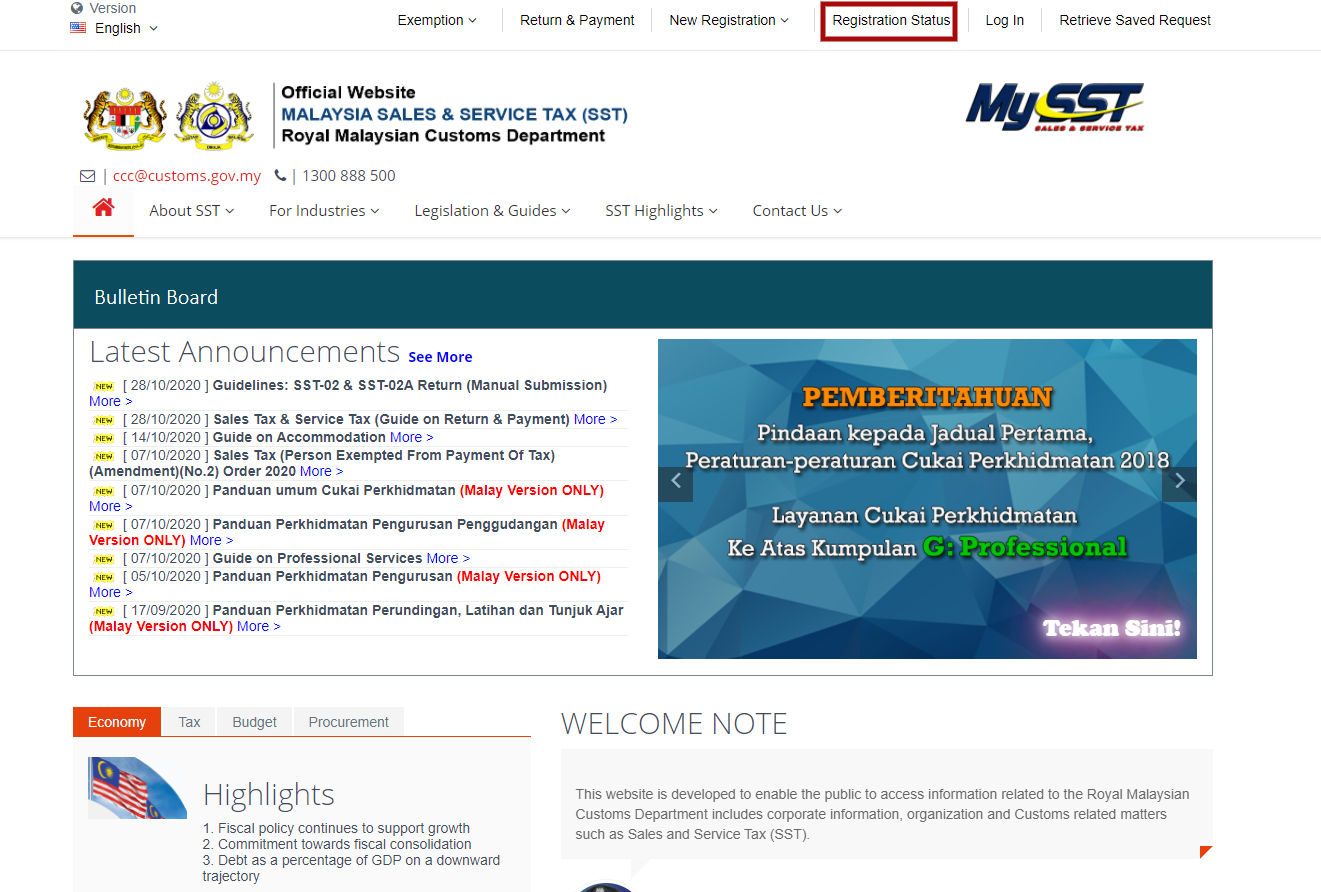

1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS. Note 1 b to this subchapter. Required on official shipping documents for tax assessment purposes a tariff code ensures uniformity of product classification world wide.

These digits are the same in all countries that use the code. For which you would like to analyze and click on search button. Unlike other countries the United States uses a 10-digit code.

The HTS Code is a classification system used to classify goods and products imported into the United States. For tax purposes the tariff codes are required on all official shipping documents to ensure a worldwide product classification uniform. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods.

The Harmonized System HS code is a categorization system created developed and maintained by the World Customs Organization WCO. Malaysia - Import Tariffs. However in some countries like USA and South Korea it is further classified up to 10-digit level.

It is used by customs authorities around the world to identify products when assessing duties and taxes and for. Malaysias trade in April increases to RM23144b theSundaily. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods.

A tariff code is a code where each product is tagged that is involved in global trading. Structure of HS Code - 61091000 for Cotton T-shirts Knitted or Crocheted. The Harmonized System is a standardized numerical method of classifying traded products.

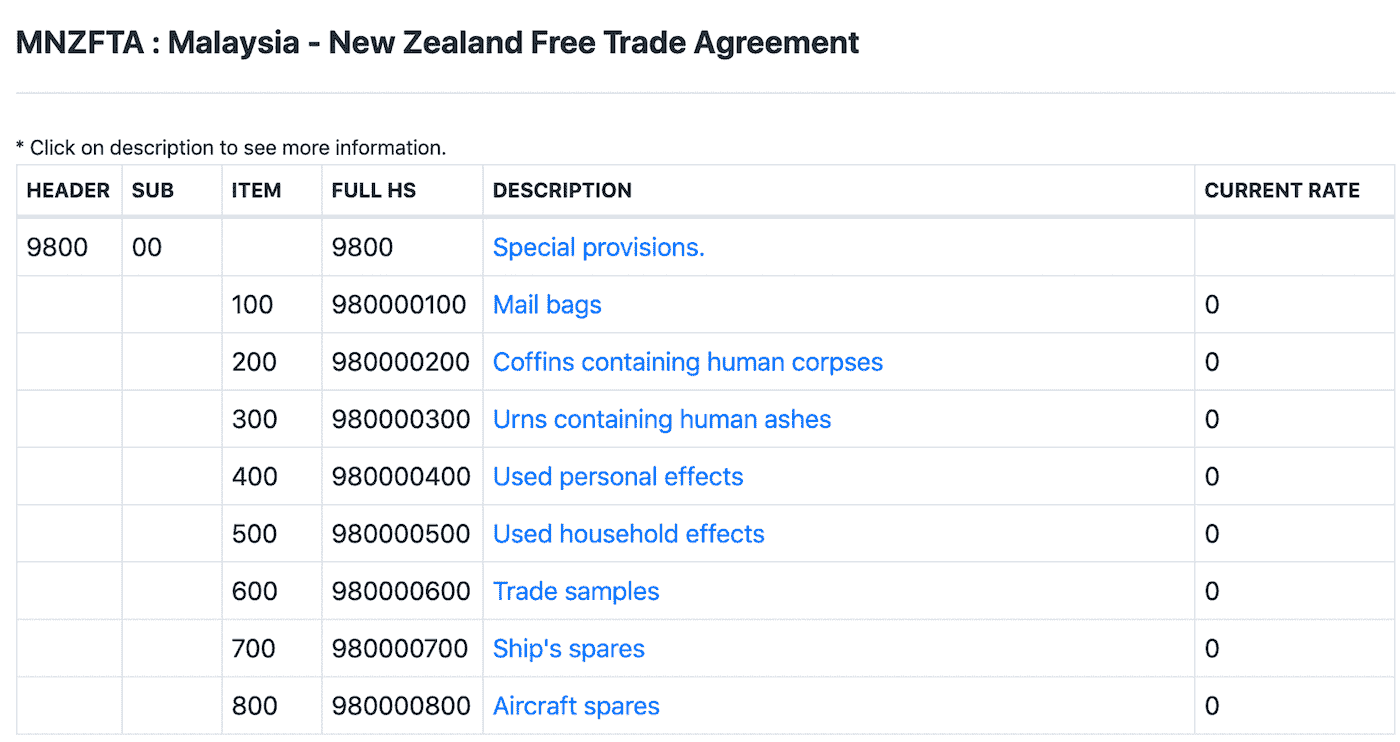

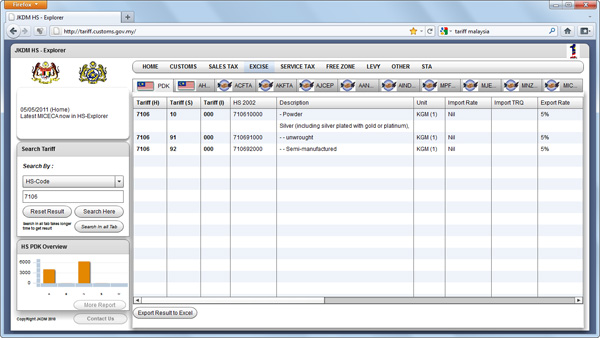

-- Choose -- PDK 2017 PDK 2017 ATIGA - ASEAN TRADE GOODS AGREEMENT ACFTA - ASEAN CHINA FREE TRADE AGREEMENT AHKFTA - ASEAN HONG KONG FREE TRADE AGREEMENT MPCEPA - MALAYSIA PAKISTAN CLOSER ECONOMIC PARTNERSHIP AGREEMENT MJEPA - MALAYSIA JAPAN PARTNERSHIP AGREEMENT AKFTA - ASEAN KOREA FREE TRADE. 什么是HS Code 进口必备的海关编码如何查询对应我商品的HS Code其实很简单今天小编就来给大家科普HS Code的重要性和如何查询HS Code吧CIEF会帮您解决进口道路上的烦恼以及提供您最快速有效的进口方案进口的道路上我们为您护航. Among industry classification systems Harmonized System HS Codes are commonly used throughout the export process for goods.

TRQ as specified in Appendix B TRQ. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint. For instance the material classification the purposes of using etc.

1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS. What Is Tariff Code Malaysia. Malaysias red-hot trade in April puts economy on solid growth path New Straits Times.

HS code stands for Harmonized Commodity Description and Coding System. IMPORT DUTY STAGING CATEGORY. The purpose of this is to adapt to the evolving needs of the global trade environment.

The 5th and 6th digits are Sub representing the more detailed commodity analysis. Firms should be aware of when exporting to the market. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint.

Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Custom Department to classify commodities when they are being declared at the custom frontiers by exporters and importers. The speed of uptake between countries has varied however large. Malaysias total trade soars 213 to RM23144bil in April The Star Online.

Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into the customs territory of the US under the terms of US. Malaysias total trade soars 213 to RM23144 bil in April 2022 MITI The Edge Markets MY.

What S In Tariff Finder Tariff Finder

What Is Hs Code The Definitive Faq Guide For 2020

Malaysian Customs Classification Of Goods Get The Right Tariff Codes

Moving Services In Malaysia Docshipper Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Moving Services In Malaysia Docshipper Malaysia

Hs Code All About Classification Of Goods In Export Import

What Is Hs Code The Definitive Faq Guide For 2020

Moving Services In Malaysia Docshipper Malaysia

Shipping From China To Malaysia Janio

Sst Tariff Code Estream Software

Freight Thailand Malaysia Rates Transit Times Taxes

De Minimis Rate In Malaysia Janio

3 Hs Codes To Know Before Importing Silver Or Gold Into Malaysia Invest Silver Malaysia Invest Silver Malaysia

Hs Code All About Classification Of Goods In Export Import

International Shipping To Malaysia A Guide For Ecommerce Merchants Janio

De Minimis Rate In Malaysia Janio

What Is Hs Code The Definitive Faq Guide For 2020